About Us

Koraput district is situated in southern Odisha between 18.13' and 19.10' North Latitudes and 82.5' and 83.23' East Longitudes covering a geographical area of 8,807sq.Km.

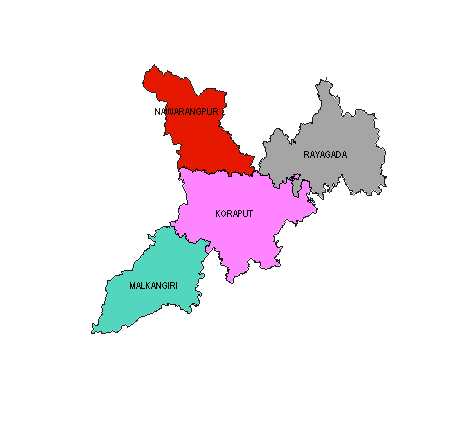

The Bank is established on Dtd.15.03.1950 and providing Banking services to the people of undivided Koraput i.e., (Koraput, Nabarangpur, Malkangiri and Rayagada) Districts. Covering total geographical area of 18,063.67Sq. Km and it is one of the biggest Bank. It has 23 Nos. of Branches and 339 Nos. of LAMPCS (338 Nos. of LAMPCS and 1Nos. of MPCS).

The Koraput District has been divided into 2 Nos. of Sub Divisions and 14 Nos. of Blocks. Further, it has 14 Nos. of Tehsils with 240 Nos. of Gram Panchayats having 2 Nos. of town and 1944 Nos. of villages. It has 128988 Nos. of KCC account holders in 10 Nos. of Branches and 97 Nos. of LAMPCS. Covering a geographical area of 8,807Sq.Km.

The Nabarangpur District has 1 No. of Sub-Division and 10 Nos. of Blocks. It has 10 Nos. Tehsils with 189 Nos. of Gram Panchayats having 2 No. of town and 982 Nos. of villages. It has 107729 Nos. of KCC account holders in 4 Nos. of Branches and 91 Nos. of LAMPCS. Covering a geographical area of 5,294Sq.K.m.

The Malkangiri District has 1 No. of Sub-Division and 7 Nos. of Blocks. It has 7 Nos. of Tehsils with 111 Nos. of Gram Panchayats having 1 No. of town and 1045 Nos. of villages. It has 70050 Nos. of KCC account holders in 4 Nos. of Branches and 55 Nos. of LAMPCS. Covering a geographical area of 5,791Sq.Km

The Rayagada District has 2 No. of Sub-Division and 11 Nos. of Blocks. It has 11 Nos. of Tehsils with 182 Nos. of Gram Panchayats having 2 No. of town and 2657 Nos. of villages. It has 77258 Nos. of KCC account holders in 5 Nos. of Branches and 95 Nos. of LAMPCS and 1 No. of MPCS. Covering a geographical area of 7,584.7sq.Km.

History of the Bank

The Koraput Central Cooperative Bank Ltd was established under the Madras Co-Operative Societies Act, 1932 on dated 15.03.1950 with headquarter at Nabarangpur and subsequently shifted to its registered office at Jeypore on dated 23.08.1972.

The Reserve Bank of India, Regional Office, Bhubaneswar has issued Banking License on dated 12.04.2010 to do the General Banking Business under undivided Koraput District i.e. Koraput, Nabarangpur, Rayagada and Malkangiri District.

The Koraput Central Cooperative Bank is having 23 Nos of Branches & 54 nos. of affiliated Large Sized Adivasi Multipurpose Cooperative societies (LAMPs) & 1 MPCS,Rayagada covering 4 districts (i.e.Koraput, Nabarangpur,Malkangiri & Rayagada).

The election was held in the Koraput Central Co-Operative Bank Ltd., and the member committee of Management was elected held on the Dtd. 09.11.2022 and Er. Sri. Iswar Chandra Panigrahi was and assumed the charge as president of the Bank.

The major functioning of the Bank is to be decided by the Management of the Bank with regard to sanction of all type of term loans for Tractor, Power tiller, Farm mechanization, Govt. sponsored loan, Loan to Emp. Cooperative Societies including all types of NFS and Non Agril. Loan along with executing D.P. note and bond for drawal and refinance from NABARD through Odisha State Cooperative Bank Ltd, Bhubaneswar, formulation of different policies including H.R. related issues and other Banking activities as directed by the RBI, NABARD, OSCB and Govt. from time to time to be presented and apprised by the CEO of the Bank for implementation.

The Bank is functioning under the regulatory frame work of RBI, NABARD, OSCB and Cooperative Department through Commissioner Cum- Secretary Cooperation, R.C.S. Odisha & NCDC, two Divisional DRCS and 6 Circle ARCS. At present all the 54 Nos. of LAMPS & 1 Nos of MPCS are managed by the Administrators.

The main objective of the Bank is to provide Agricultural Credit to the farmers through its Branches and affiliated LAMPS and to accept deposits from public and other institutions as per Banking Regulation Act 1949.

The Bank is providing Agricultural loan to the farmers through KissanCredit Card basing on the scale of finance fixed for each crop by the DLTC meeting of the different districts with duly approved by SLBC.

The Bank has achieved a total business of Rs. 1861.07 Crores as on Dtd.31.03.2024 with status of "A" category Bank with "A" class Audit Ranking by AGCS, Odisha. Bhubaneswar. The total business of the Bank as on Dtd.31.03.2024 is Rs.1730.86 Crores.

The Bank E-mail ID is ceo@koraputccb.com Telephone landlines bearing No.241159,232714

The Bank is operating under CBS platform being a Sub-member of OSC Bank with effect from 31.03.2014.The Bank is having modern banking facilities like NEFT/RTGS & IMPS which is avail by the customers for funds transfer. The Bank has installed 7 nos ATMs at 2 nos in Jeypore one each at Borigumma,Koraput,Nabarangpur, Gunupur & Muniguda.

The progress of the Bank under different parameters for last 8 years (audited) is given hereunder for favour of kind perusal.

| (Rs. In Lakhs) |

| Sl.No. | PARTICULARS | As on 31.03.17 | As on 31.03.18 | As on 31.03.19 | As on 31.03.20 | As on 31.03.21 | As on 31.03.22 | As on 31.03.23 | As on 31.03.24 |

|---|---|---|---|---|---|---|---|---|---|

| 1 | Membership | 11249 | 11326 | 11571 | 11858 | 12058 | 12052 | 12307 | 13006 |

| 2 | Share capital | 7044.64 | 7457.23 | 8467.45 | 8993.63 | 10055.49 | 11996.57 | 13095.46 | 13866.68 |

| 3 | Own fund | 7940.61 | 8455.73 | 9573.36 | 10292.20 | 11418.88 | 13987.06 | 15786.73 | 17511.32 |

| 4 | Deposit | 46663.38 | 46275.92 | 47545.97 | 50908.49 | 55662.20 | 57578.26 | 58011.17 | 65462.95 |

| 5 | Borrowings | 45802.36 | 47457.85 | 52207.96 | 57813.65 | 64201.09 | 68534.89 | 68371.11 | 73296.23 |

| 6 | Loans issued | 79781.88 | 63975.31 | 79109.05 | 84025.70 | 94068.77 | 101228.54 | 98491.13 | 1114005.12 |

| 7 | Loan outstanding | 68621.39 | 72268.94 | 78316.22 | 83781.60 | 89292.06 | 95069.59 | 101837.27 | 107623.26 |

| 8 | Investment with OSCB/NABARD | 40424.35 | 39648.61 | 43906.41 | 51930.94 | 59325.90 | 59556.38 | 57971.14 | 66588.53 |

| 9 | Working capital | 116306.23 | 119498.27 | 130516.83 | 142277.40 | 156718.83 | 165870.69 | 172664.02 | 186107.12 |

| 10 | Cost of Management | 1124.61 | 1281.94 | 1414.44 | 1156.03 | 1271.38 | 1275.11 | 1434.8 | 1783.13 |

| 11 | % of Cost of Management to Working Capital | 0.97 | 1.07 | 1.08 | 0.81 | 0.81 | 0.77 | 0.83 | 0.96 |

| 12 | Profit | 126.74 | 130.83 | 305.68 | 317.72 | 824.12 | 1091.72 | 1233.32 | 1251.61 |

| 13 | Recovery | ||||||||

| a) Principal | 68.71% | 62.00% | 65.61% | 83.54% | 84.97% | 88.70% | 83.75% | 87.63% | |

| b) Interest | 76.56% | 74.70% | 69.07% | 77.50% | 72.18% | 73.06% | 66.33% | 67.82% | |

| 14 | N.P.A. | 3438.46 | 3593.63 | 3598.40 | 3420.18 | 3451.41 | 4653.08 | 4727.96 | 5135.18 |

| 15 | % of N.P.A. to Loan outstanding | 5.00% | 4.97% | 4.59% | 4.08% | 3.87% | 4.89% | 4.64% | 4.77% |

| 16 | Per employee business | 773.72 | 817.55 | 1015.02 | 1181.49 | 1329.85 | 1511.36 | 1378 | 1587.95 |

| 17 | Per Branch business | 6404.71 | 6585.83 | 6293.11 | 6413.83 | 6039.76 | 6360.33 | 6660.35 | 7211.93 |

| 18 | CRAR | 11.59 | 11.85 | 12.36 | 12.30 | 13.29 | 15.09 | 16.11 | 16.44 |

| 19 | % of Cost of Management to Real Income | 32.95 | 30.81 | 32.74 | 25.40 | 25.12 | 35.75 | 25.89 | 30.01 |

| 20 | Audit Classification | A | A | A | A | A | A | A | A |